Are You Prepared?

Disasters, personal or natural, are unpredictable and devastating. From floods and fires to hurricanes and earthquakes – or a divorce or an illness – your life can change in an instant. The good news is there are steps you can take today to assure that you are protected from compounding a difficult life event with a financial crisis.

Since I am a financial planner, my mind always goes to the money side of things. While nothing in my bag of tools is able to prevent awful events, I want to tell you about specific actions to safeguard your future.

Rule number one: Don’t put your financial security in the hands of someone else! You need to take charge. I’ve devised an easy-to-follow checklist to help you cover the essential categories of financial information, to make sure you know what you have, where it is, and how to access it in the event of a crisis. Let’s call it the “Four W Prep Formula”.

Important but Not Urgent

I understand this task can be tedious and is likely not your idea of a fun way to spend an afternoon. Some of these topics will bring up family history, insecurities, and other emotions. To get the full picture, you may need to have an uncomfortable conversation with loved ones.

For motivation, and as a gift to your future self, reflect for a moment on the sheer number of disasters that occurred throughout 2017. Think of the added trauma to you and your family if you can’t find the information you need if one of these happened to you. As one small example: what good is the homeowner’s insurance you pay for each year if you can’t find the information or don’t have the documentation to make a claim when you need it? The only way to ensure you don’t compound a crisis is to prepare. And I’m going to hold your hand.

Let’s Go

Look through the following categories. If you end up in a difficult life situation, the items in the following categories are what you will need to be able to access.

Categories

- Insurance policies

- Bank accounts

- Investment accounts and retirement plans

- Loan documents (student loans, mortgages, car loans, etc.)

- Property deeds and titles

- Wills

- Medical records

- Pet records

- Social Security cards

- Birth Certificates, Marriage and Divorce Certificates

- Employment and military records

First, gather your records. If you are like a lot of people, you will need to dig through papers and folders or maybe speak with family members to find them.

> Download your Insurance Inventory spreadsheet here <

Four W Prep Formula

Next, for each category above, answer the following four questions. Then, store the answers somewhere secure, and be sure other key people know where to find them too.

- What is it?

- What does it do?

- Where is it?

- Who is your contact?

For Example

Let’s start with the first category on the list, insurance policies. This includes homeowners, renters, auto, health, life, disability, and long-term care, among others.

The purpose of insurance is to cover the financial risks we all face. Financial risk can be unanticipated medical expenses, significant damage to or destruction of your home or car, the inability to work due to injury or illness, or the loss of income, earning power and support due to premature death of a loved one – or you.

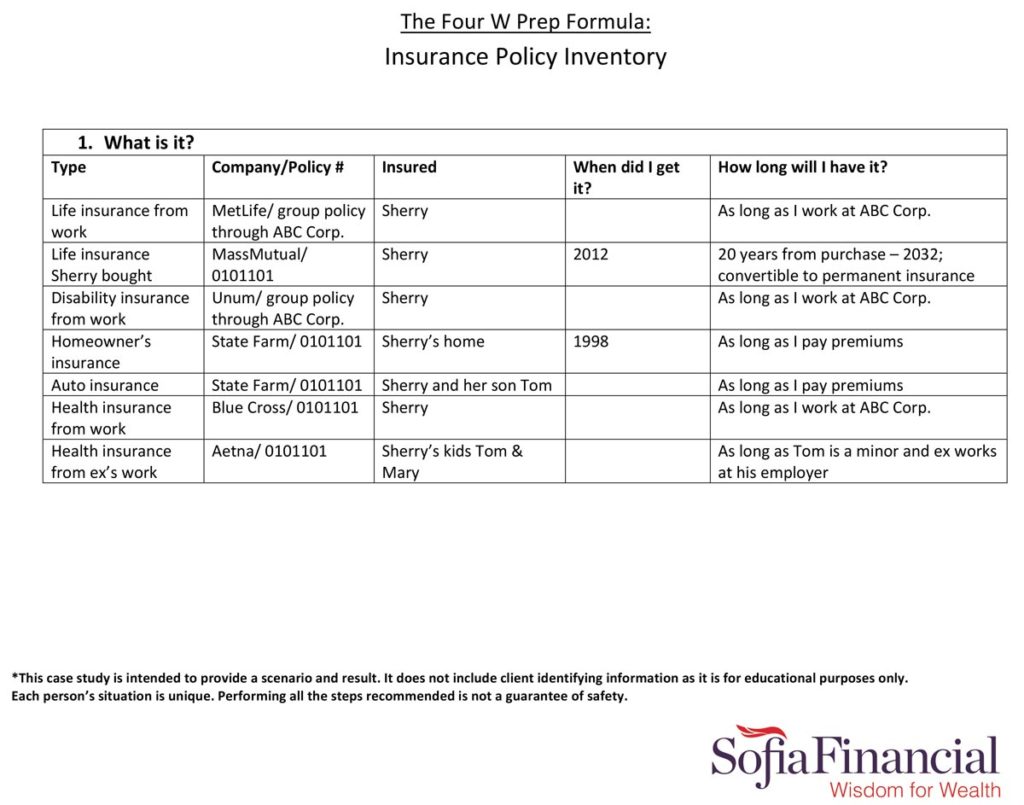

As an example, let’s look at an example of how my client Sherry followed The Four W Prep Forumula.* I’ve included a downloadable Insurance Inventory form to help you do the same [hyperlink].

Question 1: WHAT IS IT?

Sherry started by gathering her benefit booklet from work and her individual policy documents. She logged onto her home and auto insurance company website to get those details.

She came up with the following list of policies, and filled out the details in this section of the Insurance Inventory worksheet:

- Life insurance provided by her employer from work

- Life insurance policy she bought on her own

- Long-term disability from work

- Homeowner’s policy on her house

- Auto insurance covering herself and 17-year-old son, Tom

- Health insurance for her through her employer

- Health insurance from her ex’s employer covers her two kids, Tom and Mary

Question 2: WHAT DOES IT DO?

Under What Does It Do, Sherry filled in the blanks to complete the following sentence for each policy:

This insurance will pay $(benefit amount) to (beneficiary) if (benefit trigger) happens. The cost of this insurance to me is (premiuim).

For example for the first item, the life insurance provided by her employer, it read, “This insurance will pay $120,000 to my sister as custodian for my children if I die. The cost of this insurance is covered by my employer.”

For her disability insurance, it read, “This insurance will pay $6,000 per month to me if I become disabled for longer than 90 days. The cost is covered by my employer.”

For her homeowners, auto and health insurance, it is easiest to print the Declarations or Summary of Benefits page of each policy as they cover multiple possible scenarios, with different benefit amounts, deductibles and caps.

As she reviewed her life insurance policies, Sherry realized that she still had her ex-husband listed as the beneficiary on one. She had bought it years before, and although she remembered to get her ex off of her work and health insurance documents when she got divorced, she had neglected to do so for this policy. She called her agent and got that corrected right away!

Question 3: WHERE IS IT?

Step three is crucial. Gathering all the information is important, but being able to find it in a crisis is where the real value comes. It could be many years before Sherry needs to refer to the information she just put together. She needed to be sure it is safe and accessible.

I recommend you select three different locations – one physical, one virtual/digital, and one with a trusted person. Why the duplication? Each has scenarios when they would work and when they would not.

Physical: While a safe deposit box would also work, Sherry thought of Puerto Rico in the wake of Hurricane Maria, with no power for large swaths of the island for many months. If the bank has no power, it could be hard to get at what you need. So she went for a water-proof, fire-proof lock box to be kept in her closet.

Virtual: This could be as simple as a password-protected file stored in a free cloud service, or a paid secure cloud storage option. Sherry has a document vault available through our comprehensive financial planning service, and decided to load her crucial information there. Since it is in the cloud, she can access it from anywhere. Even if her house with the lock box in it floats away in a flood, her information would be available. However this is another option that requires power, and Internet access, to reach.

Trusted Person: Be sure to let loved one knows where to find your documents! Sherry realized that if she were to be ill or injured, or worse, someone else would be dealing with the details. So she made sure her sister has access, by giving her a duplicate key to the lockbox, and the login information to the virtual storage.

Question 4: WHO IS THE CONTACT?

Sherry compiled the contact information for each insurance policy, including website, phone number, and email. For some she has a local agent; for others it is the HR department of work, and she noted that name and number; also toll-free number or website.

Remember the above example is just for insurance. Sherry still needs to go through the Four W steps for the other categories on the list. That said, it’s a big accomplishment deserving of a little self-congratulation. If you complete this, it’s a great start. And hopefully you gain some momentum to continue the project.

Note that the specific questions will be different for each category, but if you follow the same structure and answer the four questions, you should feel more confident.

CONCLUSION

Our financial lives are complex. I know it can feels like a daunting task to go through this exercise. But 2017 has given us ample evidence that natural disasters can hit in unexpected places, and with unprecedented force. Personally, I don’t have to look very far into my own circle of family and friends for proof that other disasters – illness, injury, premature death – happen more often than I would like.

I urge you to take charge of your financial security. Make an investment in understanding what you have in place and how it works. Advance preparation is the secret to making sure you only have to deal with one crisis at a time.

To have a free conversation about this or any other financial planning topic, schedule now.

__________________

Download your Insurance Inventory spreadsheet here.

*This case study is intended to provide a scenario and result. It does not include client identifying information as it is for educational purposes only. Each person’s situation is unique. Performing all the steps recommended is not a guarantee of safety.